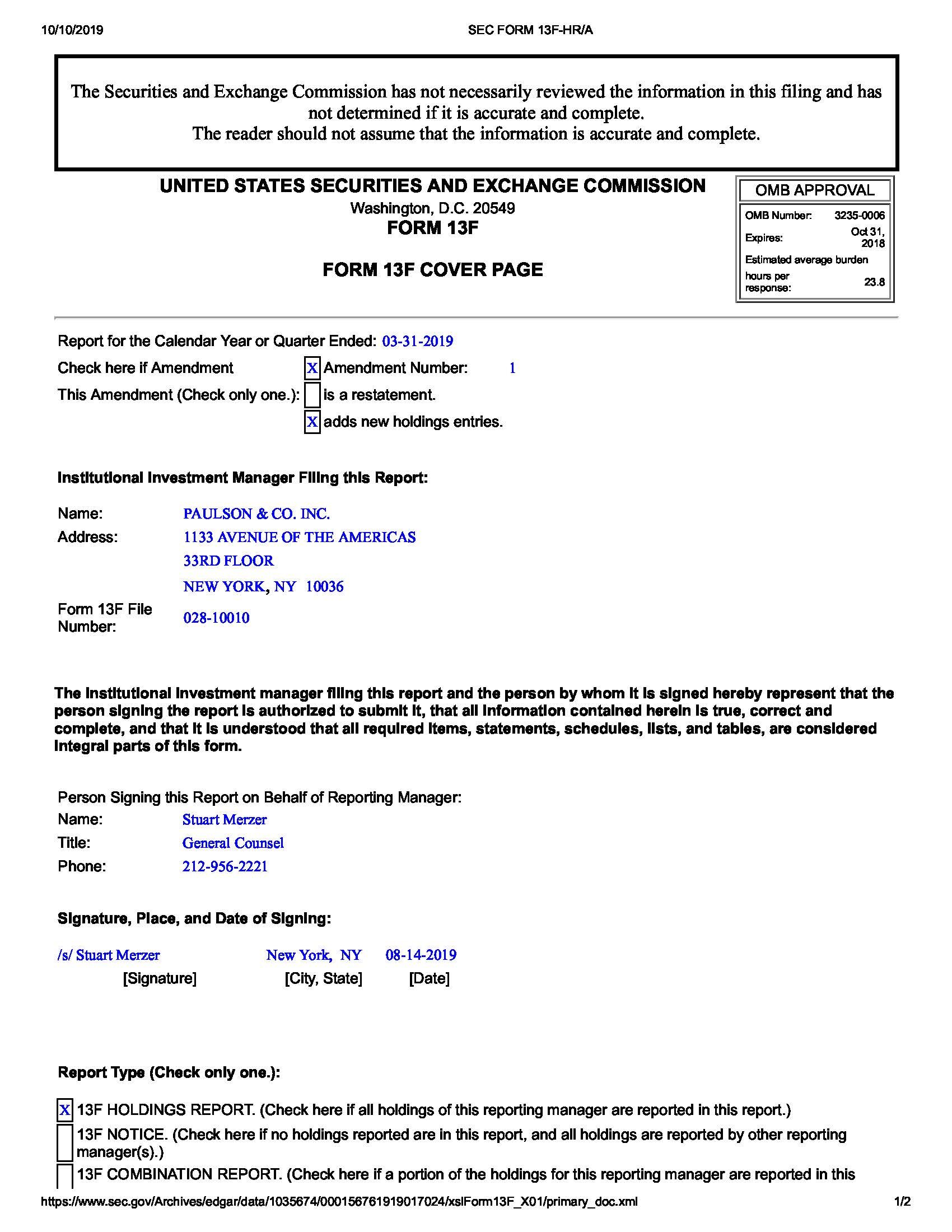

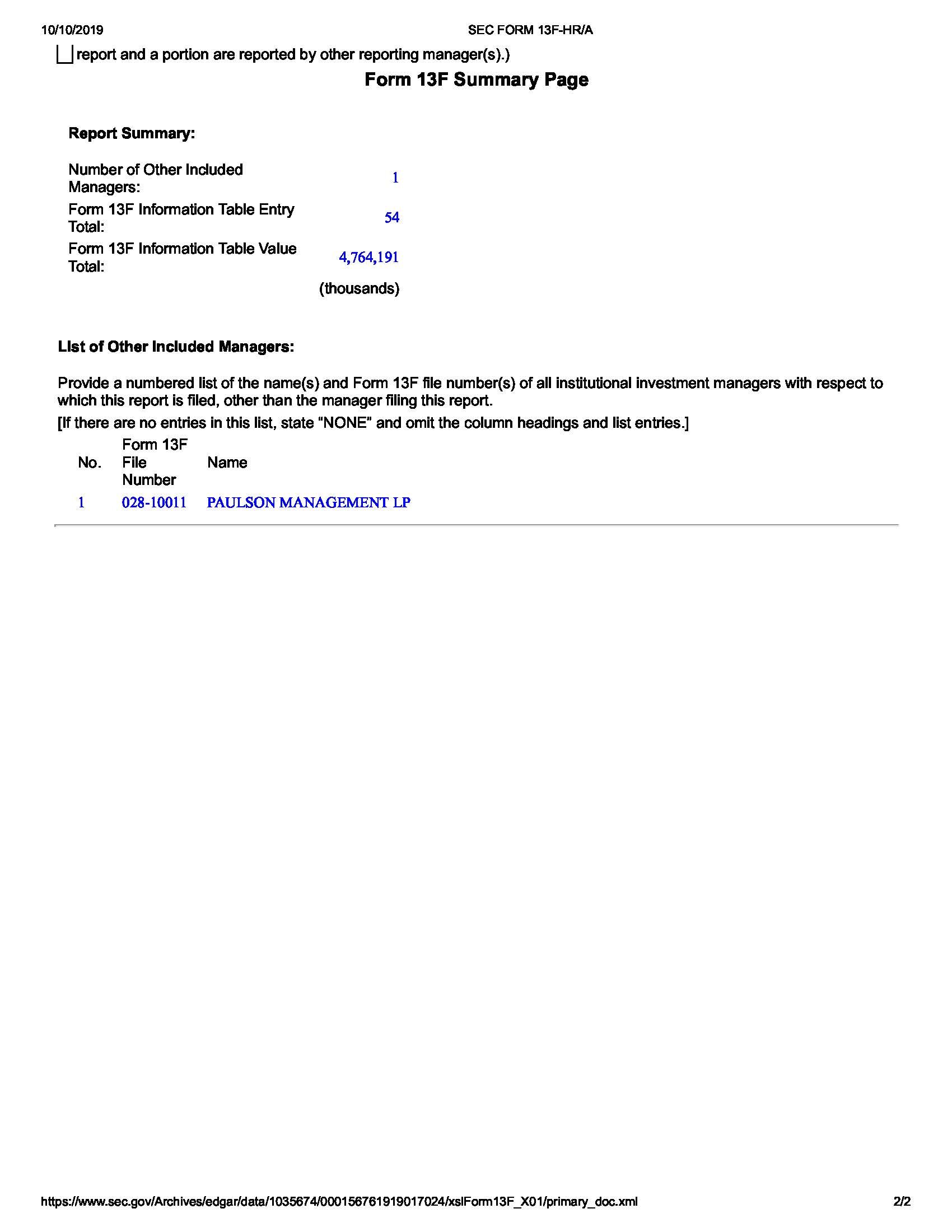

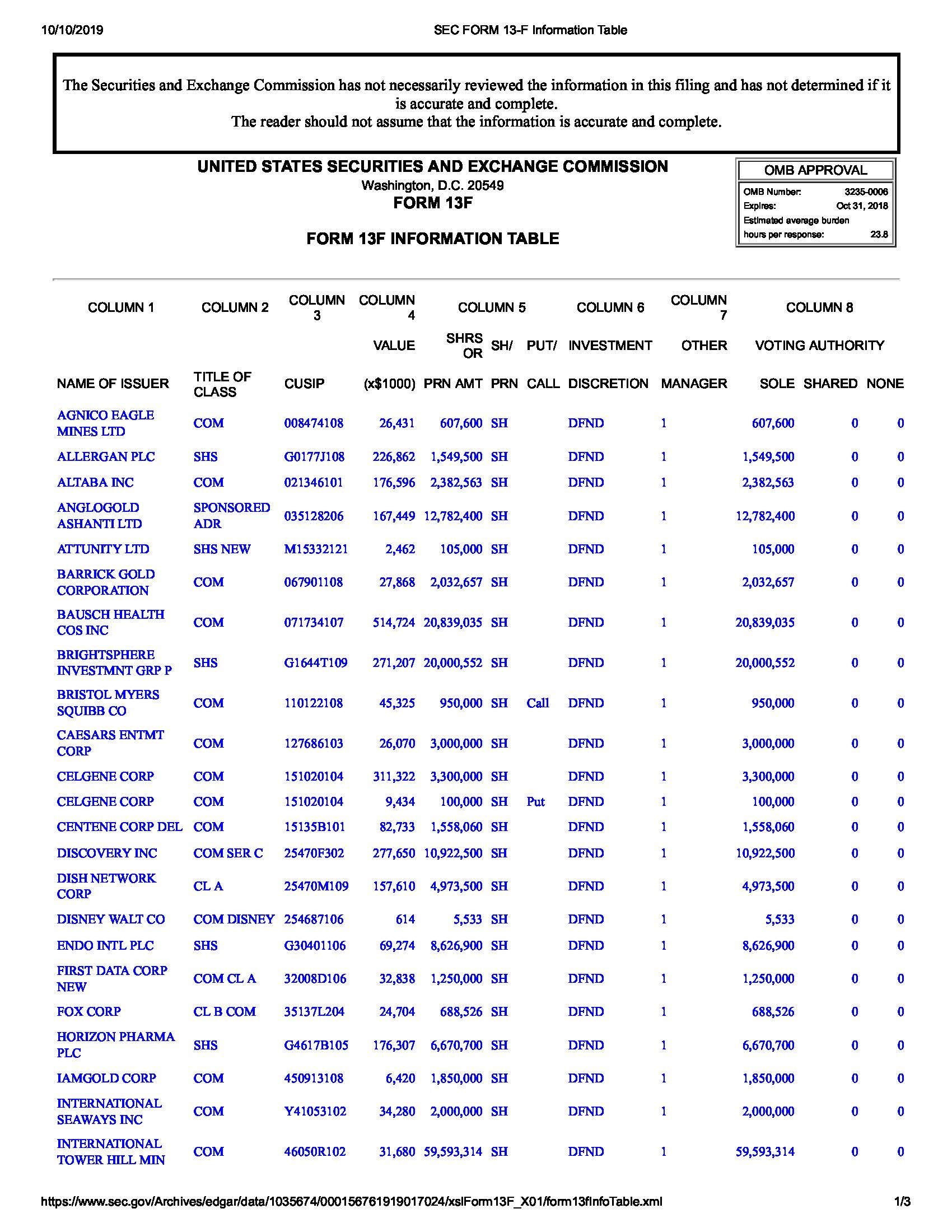

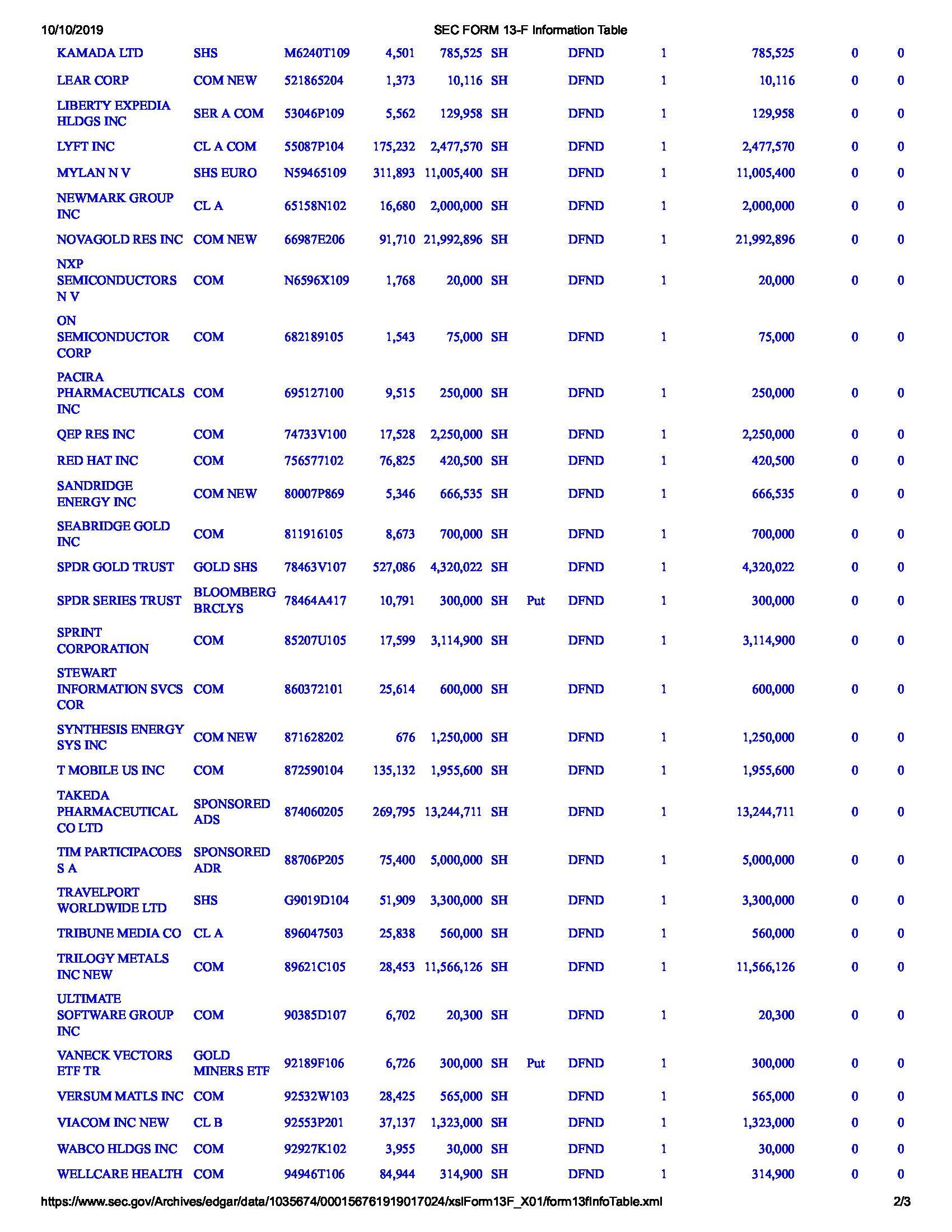

Hedge funds can pose a challenge for researchers, as they are subject to fewer disclosure requirements than publicly-traded corporations. However, researchers should be aware that they can analyze SEC Form 13F filings to gain some insights into selected hedge funds. The filings are made by institutional investment managers - such as hedge funds, investment advisers, banks, insurance companies and some pension funds and corporations - that have discretion over more than $100 million in Section 13(f) securities. Section 13(f) securities - defined by the SEC online here - generally include investments that are listed on American exchanges such as NYSE, AMEX and Nasdaq (though they are not required to disclose securities traded solely on foreign exchanges, private investments, short positions, and in mutual funds). The Form 13F requires the filer to disclose the investments they hold, the number of shares they own and the market value of the shares. Here is an example of a Form 13F, filed by the hedge fund Paulson & Company, Inc. - click on the image below to view additional pages from the filing:

Form 13Fs can be found on the SEC's Electronic Data Gathering, Analysis and Retrieval (EDGAR) database, which is available to the public for free online here. In order to see the most recent 13F filings, users should click on “Latest Filings” and restrict the form type to “13F”. In addition, the EDGAR database enables searches by Company Name, Mutual Fund, Variable Insurance Products, or Full Text searches of the entire EDGAR site over the past four years.

To learn more about Form 13F, visit the SEC's web site here and read answers to frequently asked questions here. Read this Medium piece to learn more about what can be discerned from the 13F forms. The website Whalewisdom.com specializes in analyzing Form 13Fs to learn about hedge funds, including providing various statistics on the top holdings by hedge funds and a heat map showing the stocks favored and avoided by hedge funds.